We are working in to the Mutual Fund Industry since 2002 with introducing our first of that kind Trend Setter Back-Office Software - MFInvest with unique features like Importing RTA's Data, Consolidated Reports earlier all existing software were equipped with Manual Data Punching and Excel-base Reporting only

During 2008 - 2009 when the Global Stock Markets meltdown our BSE Sensex also dropped from 21000 to 8000 level. in spite of using SIPs and STPs I had suffered huge loss in my investments which I could not digest so I started Dissecting my Investment Portfolio for searching the reason why I have lost my money, even though I was having 300+ IFAs brain, and Shockingly found that while doing SIPs/STPs I was investing same amount regardless the market risk level which turns in to Poor Averaging and my belief on "SIPs/STPs are the best method for investment in all season" was proven wrong

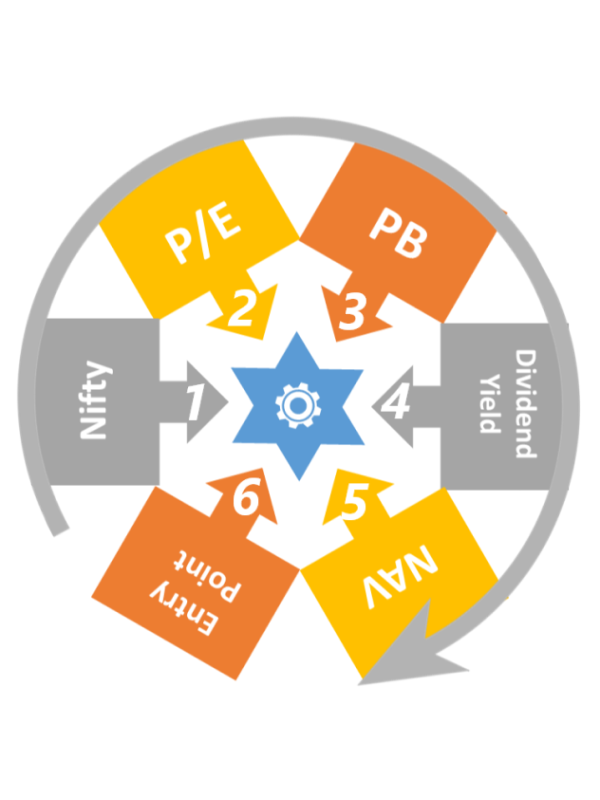

After knowing the final output of my dissection of my portfolio I started to find the solution. The main reason behind the failure of SIPs/STPs was Not Respecting the Market and its Risk Factor, but First Rule of Investment is says Buy at Low and Sale at High. For respecting market one should Invest more when the market Risk Factor is Lower and Reduce the amount when Risk increases. TO follow the Investment Rule we have design a all new Investment Strategy Called BLTP - The NeXT Gen Investment Strategy. In BLTP we are using 6 Factors NIFTY, Nifty's PE, PB, Div Yield, NAV of MF Scheme and above All 6th and most important factor is Entry Point of an investment which will define the which strategy is suitable for an Investor. BLTP is design to fulfill every requirement of an investment. BLTP is versatile and safest mechanism for investing in Mutual Funds With Downside Protection.

Satisfied Clients

“ The best part is it boosts the mind-set for Long Term Investment along with asset building. ”

“ BLTP – Magic is low risk and high return product for those who seek monthly income. ”

“ In the scenario of lower Interest Rates BLTP MAGIC is the only Option. ”.

“After the Massive

fall of 2008 I was in search of Tool which

will Protect Wealth of Our Investors &

I got the Solution through BLTP

BLTP is a Real

Magic for ALL Market Conditions

I have achieved My Financial Goal upto

23%

just in 4 Years

Time Span

In the Falling

Interest Rate Scenario or In Rising Inflation

it is Actually A Guided Missile

“It is

Always Better than SIP, STP & SWP.”

Thanks to Business Link for providing

us such a Wonderful Solution”

“BLTP

is a product that fills the vacuum of a

Monthly Income Plan that is lacking in our

country for many who have a lump sum.

BLTP is a serves as an excellent product

for retired persons as it answers to the

need of Monthly Cash Flow with possible

Capital Appreciation

BLTP - Magic's

ability to provide increased Monthly income

every 12 months serves as a good hedge against

inflation”

“ The magic

that has it to please investors during all

times.

A product

that pales the Laxman Rekha in consistency

for regular returns in good as well as at

bad times for investors.

A product the

blooms at the worst of times to bring smile

on every investors face.”

The benefit of this method of investing keep the acquisition of unit price at lower level resulting in reducing the chances of heavy losses along with maximisation of gain to the investor.

We are satisfied with the result of the mechanism.”

" Indeed

it's a Value addition tools in today's

scenario. "

" This tool create value of IFAs

by it's value based solutions. Which

helps investor and IFA too to gain in uncertain

market over longer term. This tool works

on feer and greed factor [Warren Buffett

style] which helps to built wealth and confidence

in long lerm. "

" For

me BLTP stands as Best Levels of Today's

Financial Practice.

Create Value... Gain

Value... "

BLTP Is the Most suitable mechanism for getting

Increasing Monthly Income because it is based

on Margin of Safety and also having Risk-Averse*

Approch which make BLTP the most safe and secure

investment mechanism

Pension without

Tension

* Risk averse is the description of an investor who, when faced with two investments with a similar expected return, prefers the one with the lower risk

By Using BLTP you will be ensure your Financial Goal achievement Being Safe and Secure Investment Mechanism BLTP is the most suitable for getting Incremental Monthly Income. Now-a-days BLTP is managing ₹1250+Crs across the industry

Yes you can use

BLTP as an alternative to traditional

Saving Tools

BLTP-FAAP

is the most suitable option for beating your

FDs with higher returns and also most tax efficient

way.- You may call it

Entry point

for FD Investor

BLTP-DAAP-SIP

is the option available as an alternative to

RDs - You may call it

SIP with Risk

Management

Yes there are so many options like

1.

BLTP

For making surety of your

Goal Achievement

2. BLTP-Magic

for getting your

Pansion without Tension

3. BLTP-OTMS

for Managing Hsg Soc's

One Time Maintenance

Fund

4.

BLTP-Salary-Advantage

for managing

staff's salary from

an Investment

5.

BLTP-DAAP is

a Dynamic Asset Allocation Plan with

BLTP

Downside Protection

6. BLTP-FAAP

is the most suitable option

to attract

Most conservative FD clients

7 BLTP-DAAP-SIP

is the best suitable for RDs

clients.

SIP with Risk Management