BLTP

The NeXT Gen Investment Strategy

take a look at our

BLTP

The NeXT Gen Investment Strategy

HOW BLTP WORKS

... ?

For performing BLTP

1] You have to select 2 different schemes of the same fund house one is Debt scheme in which we will park the initial fund and second is Equity scheme in which we will transfer certain amount on a specified date of each month as per instruction generated by the software.

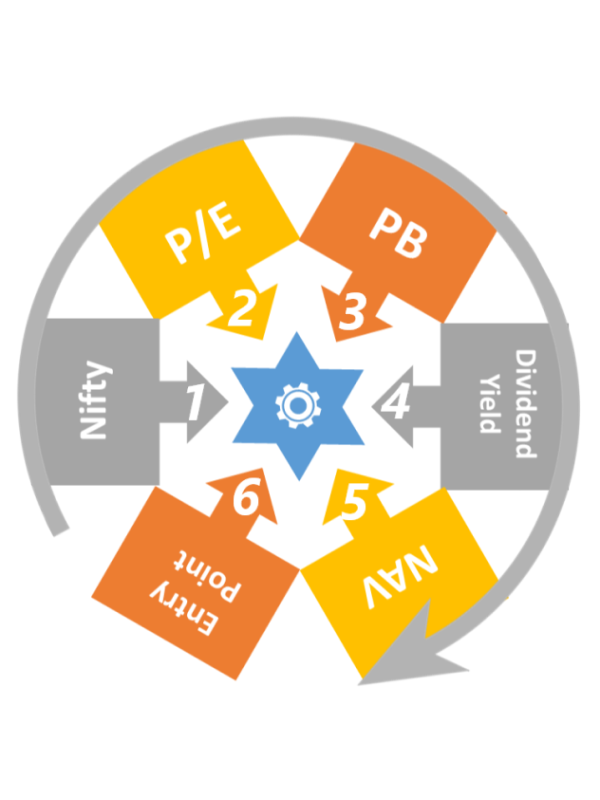

2] By monitoring the performance of the account [folio] and market condition by varifying 6 parameters and deriving risk factor Our software will guide you on a specified date how much is to be transferred to equity fund from debt fund [This process is called BLTP]

3] BLTP is also equiped with proper exit policy by monitoring the performance of the account [folio] and certain market condition Our software will guide you how much Profit is to be Booked from equity fund to debt fund.

BLTP is suitable for any Investor weather he wants to Invest Lump sum or in part or Monthly.

For performing BLTP

1] You have to select 2 different schemes of the same fund house one is Debt scheme in which we will park the initial fund and second is Equity scheme in which we will transfer certain amount on a specified date of each month as per instruction generated by the software.

2] By monitoring the performance of the account [folio] and market condition by varifying 6 parameters and deriving risk factor Our software will guide you on a specified date how much is to be transferred to equity fund from debt fund [This process is called BLTP]

3] BLTP is also equiped with proper exit policy by monitoring the performance of the account [folio] and certain market condition Our software will guide you how much Profit is to be Booked from equity fund to debt fund.

BLTP is suitable for any Investor weather he wants to Invest Lump sum or in part or Monthly.

take a look at our

Benefits from BLTP

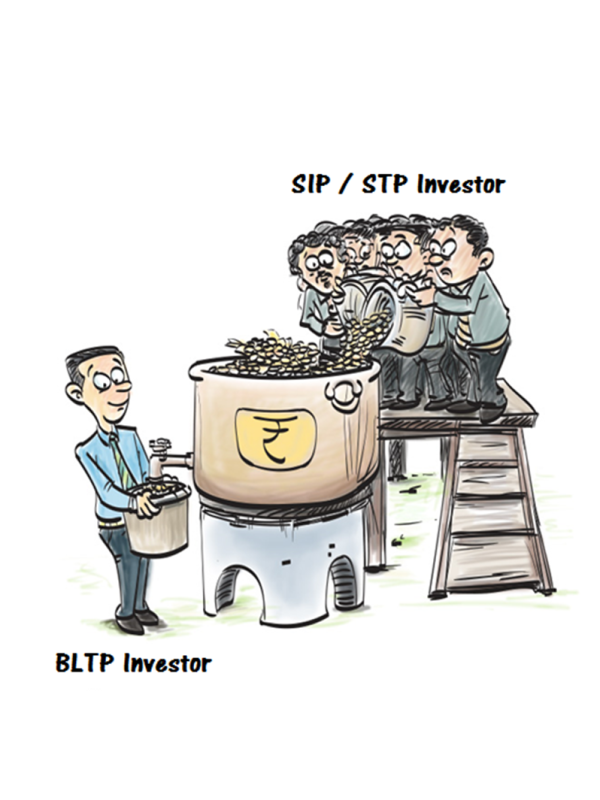

BLTP-Business Link Transfer Plan allows investors to take advantage of bearish phases in the market.

- Removes emotions from the decision making process.

- Initial investments in select debt/liquid funds enhance total returns.

- Take advantage of the market movements without hassles.

- Automatic tactical asset allocation - Advantage of investing more at lower levels.

- Active management of the investment portfolio. � Invest more when the markets are down - Accelerated investments on the date of transfer when markets are down. Which leads us to acquire more units

- In a bullish market, reduce the investment amount till Rs. 0 - Aids in keeping the Acquisition cost at lower level.

- By acquiring more units at lower NAV, we can achieve better (MOS) Margin of safety - which protect us from heavy losses due to market fall. (Divide the Losses)

- As we have acquired more units at lower price, hike in NAV will boost the profit two ways, one by no of units and another is by lower acquisition cost (Multiply the Profits)

- Tax efficient Profit bookings (apart from FEAR & GREED Factor) at favorable market without missing any opportunities.

Investment Consulting

Share your requirement

Goalbase Planning

Contact Details |

Business Link Consultancy Services |

| A-6 Madhoor Mangal Avenue Phase - 2, |

| B/h Vanvihar Colony, |

| Nashik 422007 |

| Contact No. |

| (+91) 93715 21221, |

| (+91) 70202 10271 |

| Email: |

| business_lnk@yahoo.com |

| Office Hours: |

| Monday - Friday: 9:00 AM to 12:30 PM |

| Face Book |

| Google+ |